On Epic's acquisition of Bandcamp

Reflecting on the upsides of a transaction that may seem to have none.

Components began monitoring Bandcamp's homepage sales feed, which publishes information on every sale made on the site, in late August 2020. As of this writing, the database we've compiled includes about 29 million sales, and four million albums and tracks. In late 2020 and early 2021, we published two projects with this data. The first was an interactive map of genre tags from cities around the world that lets users examine cities' musical identities, as well as the nature of genre itself. The second was an exploratory data analysis of about 7 million sales in the third quarter of 2020 that, to my knowledge, remains the largest publicly-available, quantitative analysis of the platform's economics.

The report posed a simple thesis: Bandcamp is profitable and Spotify is not, because Bandcamp's minimalist business model — allowing the exchange of money for music and merch on terms that artists and labels set themselves — provides the opportunity for people to spend as much as they want. The premise that people want to buy things makes the company something of an overlooked pioneer in applied behavioral economics. By contrast, Spotify adheres to an outmoded understanding of humans as economic agents that seek nothing but cost minimization. Its $10/month spending cap for an individual subscription not only prohibits the behavior that Bandcamp is built upon, but causes it to lose money nearly every quarter.

In all previous Components projects, a dataset has been curated, utilized, and then archived as we move on to other pursuits. The Bandcamp data has proven the exception; its abundance and detail has always suggested that lurking within is a complex set of best practices for musicians and labels to follow in an era besieged by streaming services. For the past year I considered making Components the home of something like the Billboard 100 for the platform, with monthly charts of the artists who had made the most money. The idea was that outsized success might point to a discovery worthy of emulation, and a layer of transparency about how much exactly people are making on Bandcamp could point the way towards everyone making more.

The day Epic Games and Bandcamp announced that the former would acquire the latter, we were in the midst of publishing that very side project. The results for February came out like this:

If there's one thing I'm fairly pessimistic about regarding this acquisition, it's that the spigot of free data that would allow such charts to be regularly published will almost certainly close: as a capital T Tech company, Epic is guided by an impulse deep in its brain stem to protect any and all data from its rivals. This would be consistent with their past behavior: the company publishes no data publically about its in-game shop or any other part of the platform, and information compiled by third parties on the internet is limited to rough estimates of the game’s monthly active user count and revenue.

But beyond this, my reaction has been markedly different from the apoplectic shock I've seen expressed by others. What I instead saw in the news was a genuine possibility that the acquisition could fulfill the very same recommendations we made for Bandcamp at the end of our report.

Before I reiterate those recommendations here and explain why the acquisition might precipitate them, it's worth affirming all the good reasons for skepticism, as well as acknowledging Epic’s track record. For a more thorough rundown, see Mark Hurst's response published the day after the announcement, the Twitter thread from the Future of Music Coalition, and Ted Goia's reaction. In brief: Acquisitions tend to compromise the original integrity of acquired companies. Epic has received major investment from the Chinese tech behemoth and CCP bedfellow Tencent, which makes WeChat and has stakes in both Spotify itself and major record labels. As Hurst identifies, Epic's flagship game, Fortnite, is "loaded with dark patterns encouraging addiction in its mostly teen and pre-teen user base." The company has been plagued with various scandals relating to its internal practices. Of non-trivial significance in a discussion involving creative industry acquisitions, Fortnite itself is a Disneyfied battle royale that sucks on most aesthetic levels.

The responses I've seen have tended to preemptively react to worst case scenarios, as well as express a general sense of unease at the idea of the world's largest marketplace of independent music becoming a subsidiary of a growth-obsessed parent company. People have feared that Epic could slash artists' share of sales (very possible), turn Bandcamp into new Spotify (extremely unlikely), and do away with the commission-free Bandcamp Fridays (something that may be overdue anyway).

What I haven't seen is much consideration of a future in which this event provides significant upside for the economics of music as a whole, and how it might address the long standing shortcomings in Bandcamp's execution of its stated mission. Epic is not Blackstone; this acquisition is almost certainly not a private equity-style raid. Instead, what I see is the possibility of a corporation taking out a short on the endlessly subsidized streaming model and going long on a sustainable and profitable alternative. In other words, I see the possibility of Epic re-normalizing the purchase of music.

At the end of our report, we provided four recommendations that we hoped the company would take. I want to interpret Epic's purchase in light of them:

*

The company should extricate itself from a state of technological and branding inertia. Bandcamp, as much as it has endeared itself to artists and listeners (and, it should go without saying at this point, to us), has felt like it calcified right after it was created. The site is slow. Elements of its layout are weirdly counterintuitive. You can't download music in the app [Note: this feature was added a few months after the report was published], and the app allows only low-quality streaming. The API offers no meaningful ways to integrate the platform with outside services.

One reader I spoke with expressed confusion as to why any of this matters. My answer is that all of these pieces increase the service's surface area. People who want to bolster the model that supports direct payments to musicians should also want the largest company doing so to be a household brand name, and should want the ability to make those purchases disseminate as widely as possible. While Spotify has created an API that can be inserted anywhere and everywhere to a level of inescapability, Bandcamp hasn't — novel ways of promoting music and its sale (our report gave the hypothetical of allowing NTS Radio listeners to buy tracks while a mix was playing) have never been explored.

Jules Becker, a member of Components who is far more familiar with Fortnite's intricacies than I am, sees little limit to the potential placement of sales endpoints throughout the game. He envisions a logical expansion of an already vast in-game marketplace (and payment system) for skins, emotes, and sound and music that can be tied to various player actions like dances, used on loading screens, and gifted to other players; the monetization and growth of a currently robust virtual concert schedule; the growth of vehicle radio stations; and an ability for artists themselves to sell other assets, like digital merch, to players — something currently available on a limited basis for big artists, but that could be standardized and offered more widely. And of course, there's the possibility of virtual Bandcamp storefronts.

For better or worse, Epic is a metaverse-minded company, which simply means it's obsessed with the very concept of integration. They have the capacity to make their products as accessible and inescapable as Spotify.

**

The company should actively entice more large artists to release music on the platform to not only bring in more revenue, but also to normalize the platform beyond its niche position. Convince a few larger artists to release an EP not available on streaming platforms and see what happens.

My few conversations with people at large labels have led me to believe that the majors see streaming services as a deal they want out of. One person went so far as to simply tell me that the managers of the largest music company in the world "hate Spotify." Meanwhile, Taylor Swift's zealous fans keep her playlists on repeat while they're at school so she accumulates penny fractions out of their support. When I've suggested that Bandcamp offers a no-brainer intermediary between the two, people in the industry have either been unfamiliar with the platform, or said that manually uploading a major label’s entire catalog to Bandcamp (something made vastly easier on streaming services) feels infeasible for catalogs containing oceanic amounts of music.

While these responses justify the report’s first recommendation about branding and integration, it may be necessary to also repeat what I think is the overarching goal for anyone who counts themself a member of the faction against the hegemony of streaming: Between 2006 and 2007, two paths emerged for the future of the music business. One was Spotify, and the other was Radiohead's pay-what-you-want release of In Rainbows, which directly inspired Bandcamp's founding. The war is won when the industry retraces its steps back to the fork in the road and takes the right turn.

This epochal reversal can't happen if major labels continue to hold out, and they will continue to do so until they have a platform that both can and actively tries to accommodate them. I see no reason why Epic wouldn't try to do this; when your in-game concerts include Travis Scott and Marshmello, the tendency is naturally to push those artists toward releasing music through the music company you own.

***

Bandcamp should recognize that it can grow the most under certain market conditions that favor it...The company should consider meeting with other companies that stand to benefit from rigorous antitrust enforcement, like DuckDuckGo, Affinity, and a whole host of others, form a trade group, and hire some lobbyists. Right now, the only related group that exists is the Coalition for App Fairness, a trade group formed by Basecamp and Epic Games primarily interested in reducing Apple's 30-percent app store fees. Reducing these fees is, in the long run, probably important for Bandcamp to reach a certain level of growth: The entire reason that Bandcamp does not allow in-app purchases is so that it can preserve its revenue split with artists without having to also cut in a trillion-dollar company.

Our report is the only webpage I'm aware of to publish the names of Bandcamp and Epic in the same breath before the acquisition announcement. While Epic's lawsuit against Apple ultimately failed to remove the 30-percent fee, it remains one of the company's chief antagonists.

But Apple aside, Epic is antagonistic generally, operating in a fiercely competitive industry. This has led it to inject the kinds of gross dark patterns to which Hurst alluded to hook its players. It also means the company is capable of identifying its opponents in a way that Bandcamp has proven unable or unwilling to. As we wrote in our report, "[Bandcamp CEO Ethan] Diamond once compared Spotify to the radio, a place to find new artists. Except that while Bandcamp may see streaming platforms as a complement, Amazon, Apple, and Spotify, which have spent the past decade devouring entire markets, rarely see themselves as complements to anything." This absence of antagonism in Bandcamp’s culture has functioned as a major operational deficit, stymieing its growth, and therefore obstructing the amount of money directly flowing to musicians. It's not unreasonable to expect this opposition between Bandcamp and Spotify to heighten under Epic's ownership despite Tencent's investment in both — after all, a savvy investor understands the importance of hedging their bets.

****

Finally, if any of these suggestions are too much for the company's past investors to swallow (conjecturally/hypothetically/etc.), the founders and/or employees should see if there's a way to buy them out. Hopefully the opposite is true, and the investors actually understand that starting a new Spotify is not smart, that the political tides have changed, and that the odds of Bandcamp becoming the portfolio whale they hoped for in the beginning, by creating value instead of violating antitrust regulations, is greater now than it was ten years ago.

I consider the acquisition to be a version of this already happening. The longer I spent analyzing Bandcamp and reflecting on both its business model and the context of the music business currently, the more I came to believe it was a sleeping giant that for some reason no one had thought to prod awake. Assuming Epic doesn't manage the company like Gordon Gekko, there's no reason to believe they don't believe the same thing.

______________

All of this is wishful thinking, literally, in that these are all things I wish are true. They don't have to be. When the ink dries on the deal, Bandcamp will be Epic's property, and there will be little preventing it from slashing artist compensation to 40 percent and firing everyone except the bare minimum number of sysadmins needed to keep the site running in its current form. This is the type of future envisaged in the most pessimistic responses I've seen.

But the numbers I've examined for the past year point to compelling reasons for Epic to follow a less destructive path, one that helps re-normalize a sane music economy and provides the entire industry with the opportunity for a do-over. It is important to keep in mind that in an era of Twitch streamers, Patreon creators, and Subtack writers, music streaming services increasingly make music the exception, not the rule, to the direction much of the digital cultural economy is headed.

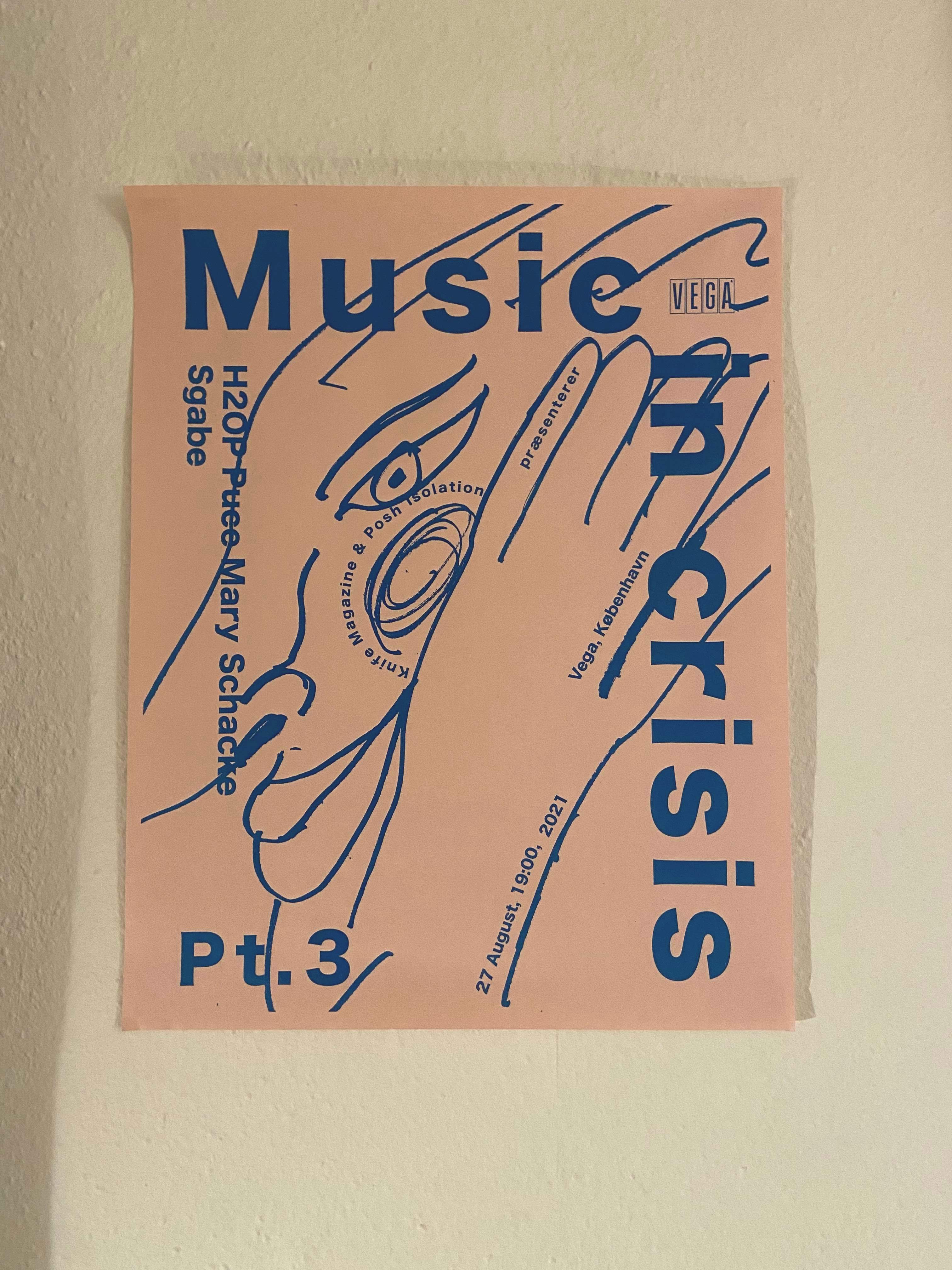

There's a print of a concert poster above my desk promoting a show of artists from Posh Isolation, a Danish label. I bought the poster on Bandcamp, as I have much of the label's music.

Crises require a set of uncomfortable responses. They necessitate that one, as Venkatesh Rao puts it, be slightly evil. The candidate whose piety keeps them from bringing up their opponent's missing emails is the one who loses. It is not an exaggeration to say that the world Spotify wants is one in which art has no home. If Bandcamp has responded in a way that smells of moral compromise, it may spell the end, but it may also mean they're on the right track.