Update 6/1/2023: A follow-up to this project focused on musical formats can be found here.

Summary

This report argues that Bandcamp's basic business model of potentiating people's various impulses to pay for things and allowing those impulses to freely interact, modulate, and compound one another has turned the company into one of the most chimerical in Silicon Valley: a profitable startup run on mostly outmoded technology. It argues that this contrasts to Spotify,1 which routinely loses money due to that company's ultimate long-term ambition of monopolization and the removal of the human musician entirely. Finally, it argues that Bandcamp's marketing and software development efforts, while good intentioned or at least neutral, leave enormous potential untapped.

Introduction

When it launched in 2008, Bandcamp’s founders envisioned the site as a “publishing platform for musicians” that would do for recording artists what WordPress and Blogspot had done for writers: offer them the means of maintaining a reliable, fully customizable web presence. But in giving musicians the ability to upload songs and albums to their pages, Bandcamp’s engineers soon realized they had stumbled into an architecture for a grassroots online marketplace, one that represented an appealing alternative to the then-dominant iTunes Store. Rather than follow Apple’s lead and set a standardized price structure, Bandcamp looked instead to the example set by Radiohead the year before, when the choice to grant fans the ability to pay whatever they wanted to download In Rainbows turned the album into a global sensation. “Maybe your album’s 200 tracks and you spent ten years on it,” Ethan Diamond, one of Bandcamp’s founders, said in a recent interview. “But you should be able to set the price yourself because you know your audience better than we do, and if somebody wants to come along and pay more than you set as that minimum, then great.”

Bandcamp publishes the sale of each item through a live feed on its homepage. We retrieved that data through the endpoint that powers this sales feed once per minute, since hitting the endpoint more often did not yield more results. We then joined that data with data from individual albums, which were retrieved separately. In total, roughly 6.7 million sales were logged, and a little more than 1.2 million albums were successfully retrieved.

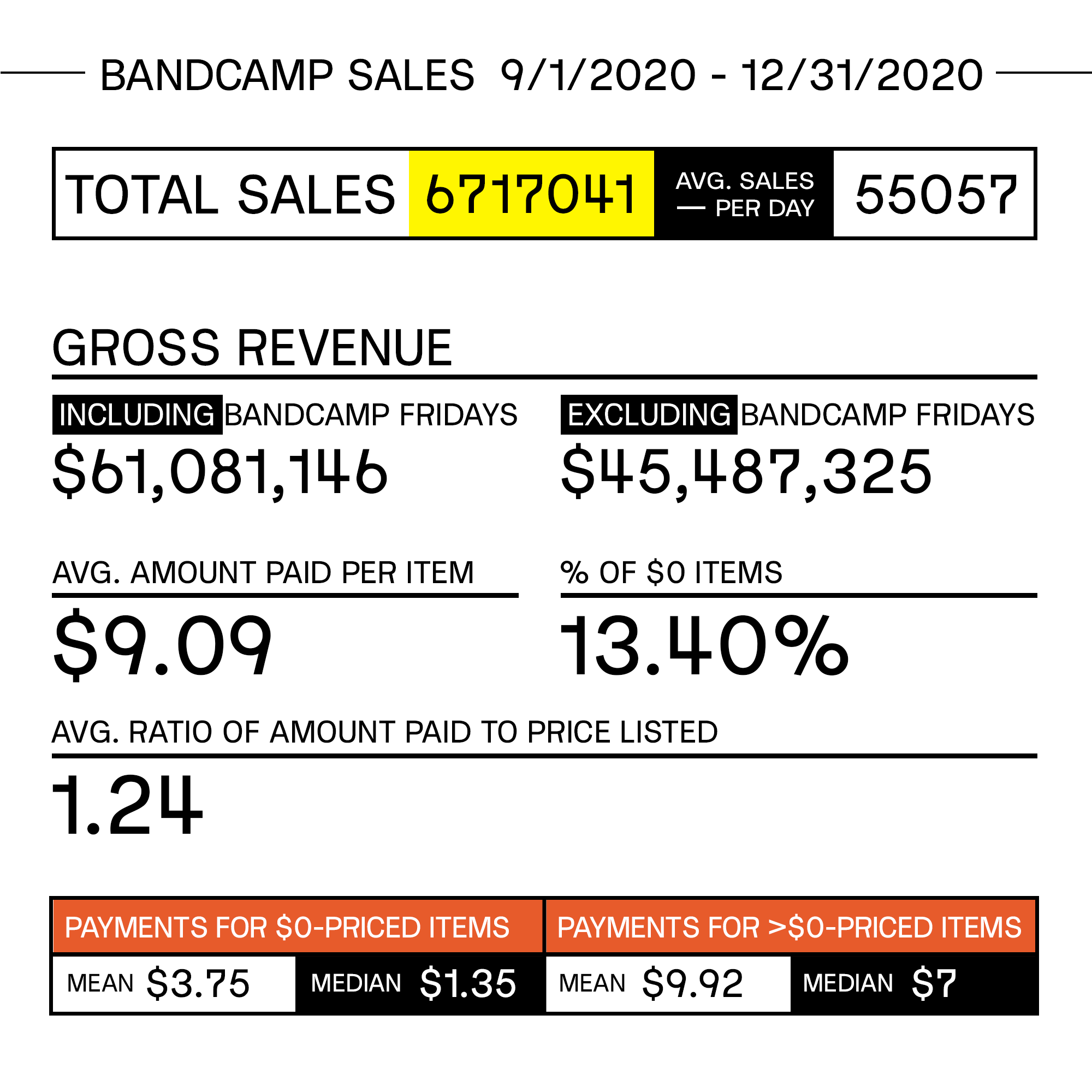

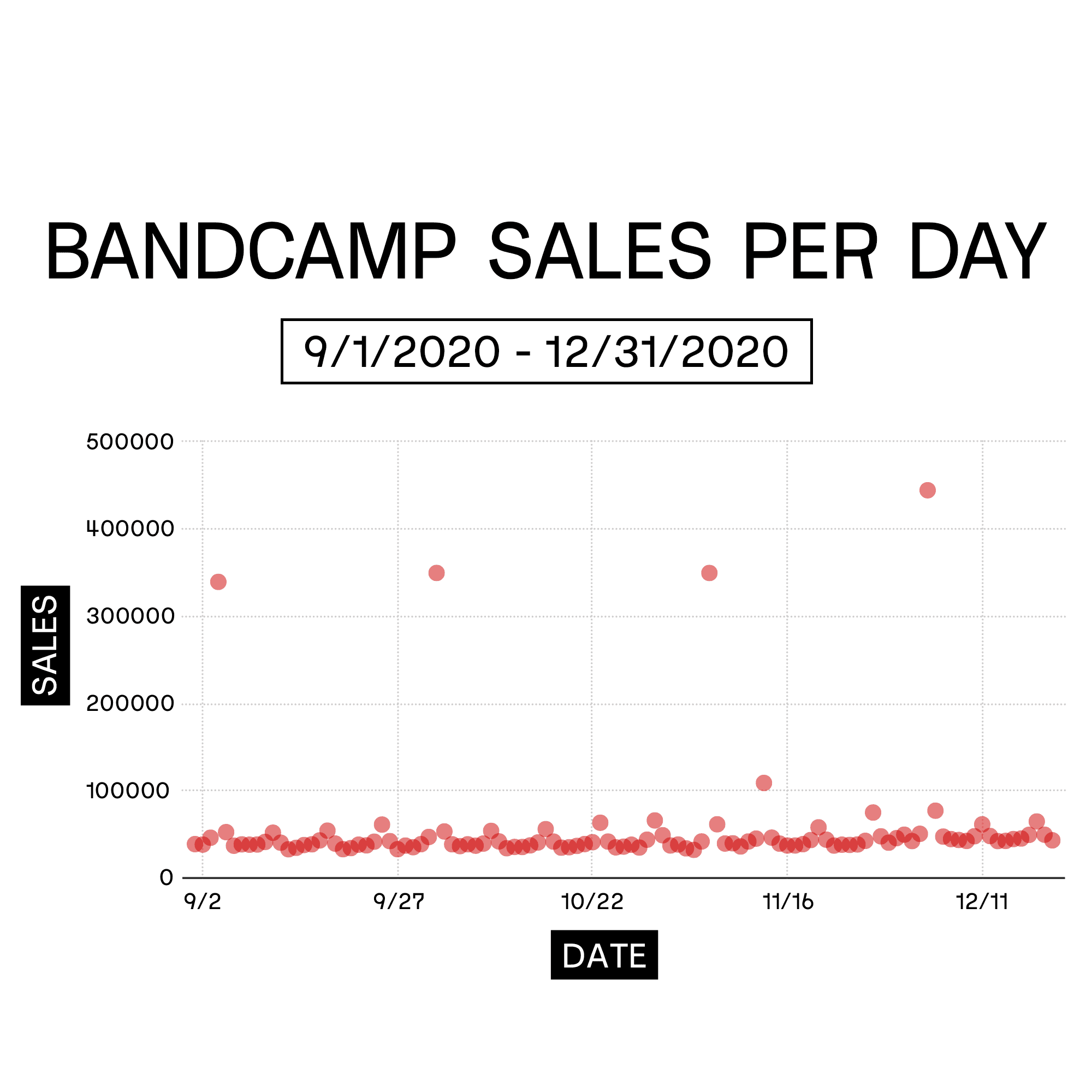

Here's a brief overview of activity on the platform between the beginning of September and the end of December 2020. Many of these numbers we'll break down in more detail as we go on, and we'll use a lot of the language in this graph and notation throughout, some of which might not be immediately clear, so let's break down two terms that might not be self-explanatory:

The “average ratio” of price paid to price listed is an apples-to-apples currency comparison. For example, if an item costs 1000 Norwegian kroner and a buyer pays 3000 Norwegian kroner, the ratio is 3. Across all of Bandcamp, people pay on average 1.24 times the price sellers list for their items. (The data from Bandcamp's sales feed includes both the amount paid in the seller's native currency as well as the amount paid in US dollars — which, as far as we know, follows PayPal's conversion rates. If an item is from Norway, the amount a buyer spent is listed in both kroner and dollars.)

"$0 items" refers to items that have no price floor and are pure pay-what-you want (PWYW). Keep in mind that, even when purchasing “$0 items,” buyers typically still have to pay something to cover processing fees, and as far as we know, the price paid for these items will always be greater than 0.

Fridays are generally the site's biggest days, which is also when artists are more likely to release albums, although how much more likely is beyond the scope of this study.

The numbers above 300,000 are Bandcamp Fridays (which we'll call BCF), occasions when the company waives the 15-percent cut it usually takes out of every transaction. Since the introduction of BCF, artists have begun aligning releases accordingly, and BCF is now not only the day when people buy the most, but when the most music is released.

What about that non-BCF on November 13 with just over 100,000 sales? Well, on that day, Phoebe Bridgers released a cover of the Goo Goo Dolls' "Iris", of which she sold 43,942 copies for a total of $178,735. The track was available for a limited time, and the item page is no longer on Bandcamp. As it happens, Bridgers's sale of this track is oddly important, and we'll come back to it towards the end.

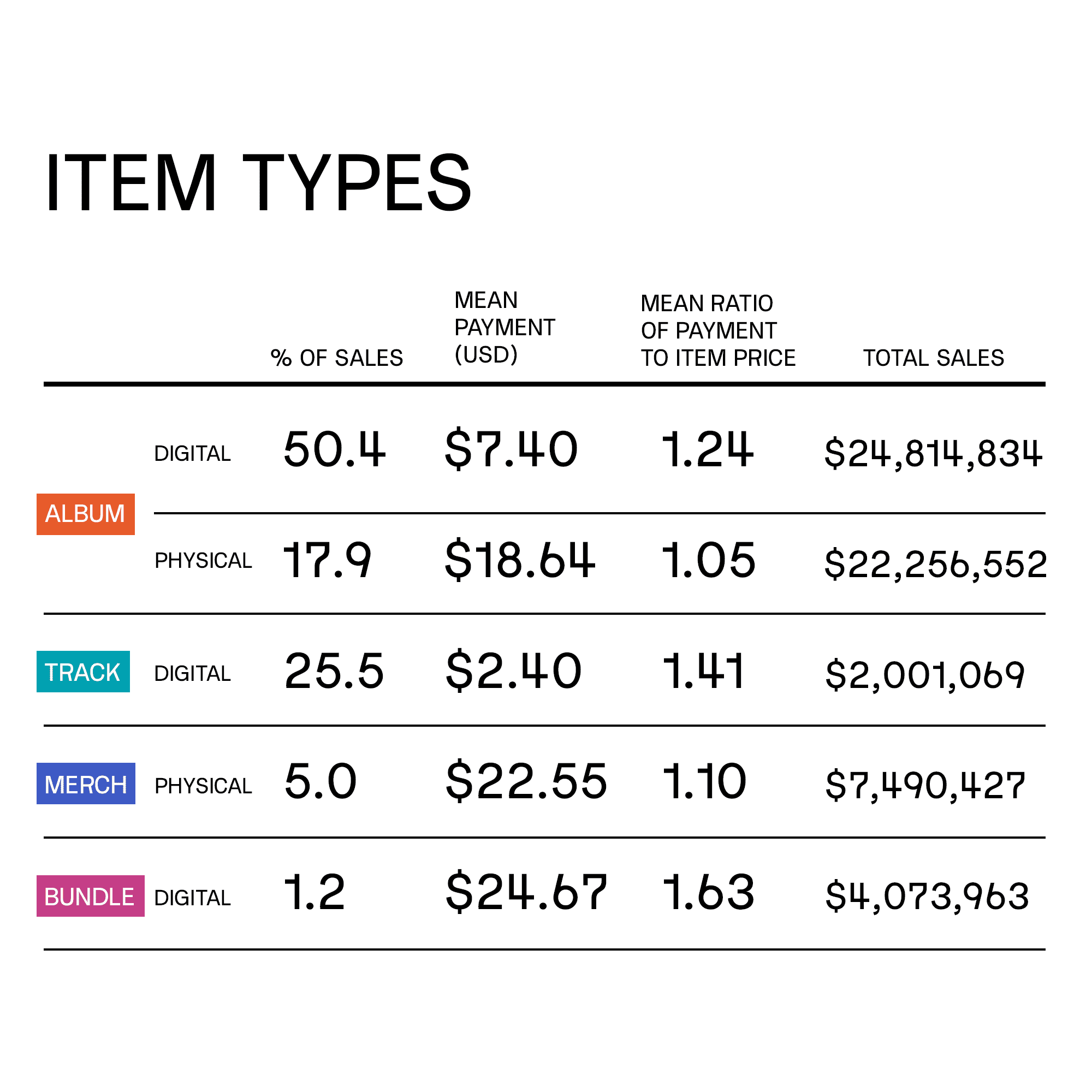

First, "Bundle" refers to digital discographies, in which artists sell all or many of their albums for a discount. The ratios here include only items whose list prices were >$0.

Bandcamp is now one of the largest sellers of physical music — vinyl, CDs, cassette tapes — anywhere in the world. Physical items account for 22.9 percent of all sales, but make up 49.1 percent of money spent. That outsize share mostly comes from physical albums, which alone constitute 36.7 percent of all money spent.

Cost might modulate generosity to some extent, as people pay more for lower priced tracks than for digital albums. Although artists charge more for their bundles than merch and physical albums, people still elect to pay even more for them than those physical alternatives. Additionally, people aren't less generous when paying for the typically more expensive merch than they are for physical albums. Removing outliers changes the mean ratio for each product category, but it doesn't change this overall relationship.

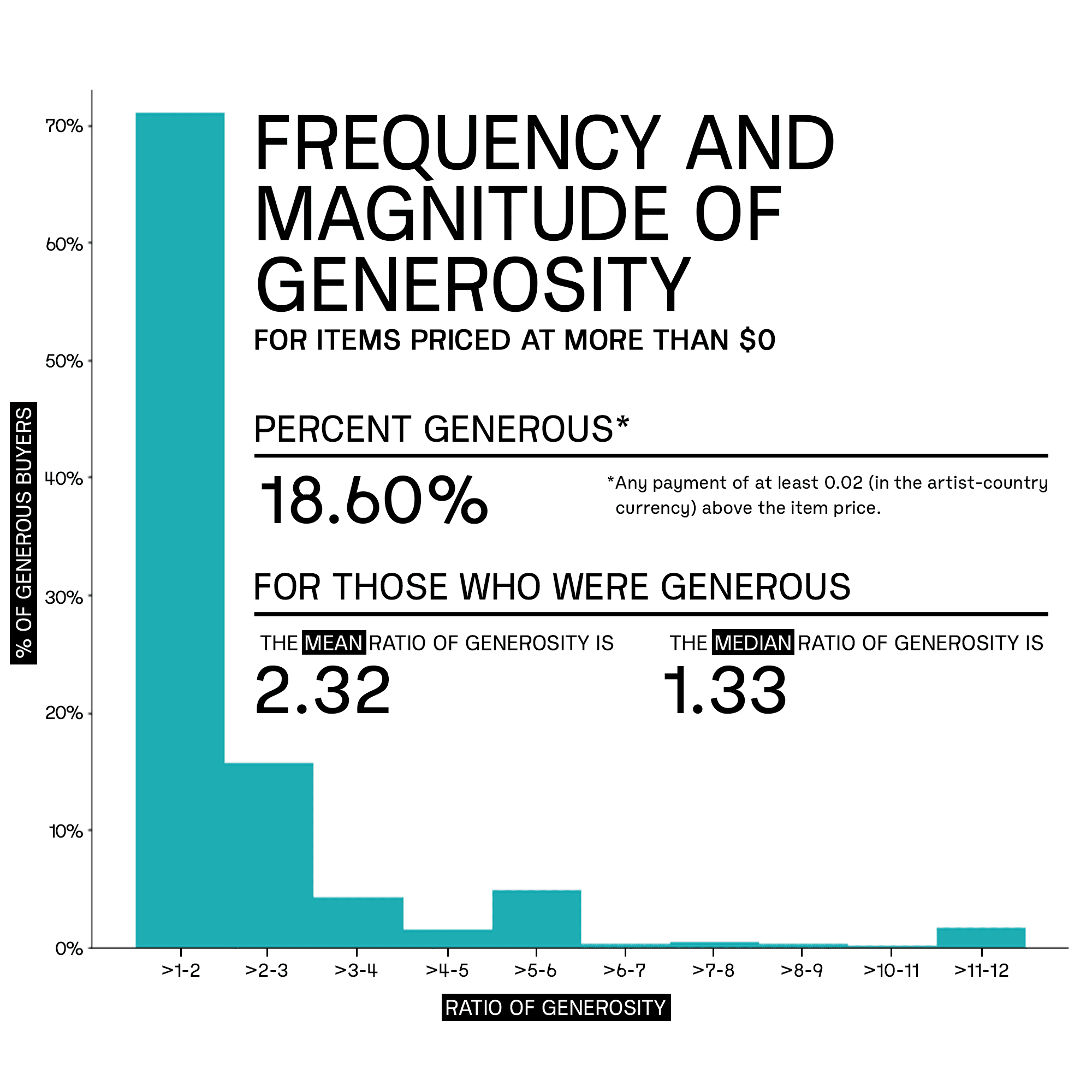

Determining whether or not a buyer behaved generously — i.e., whether they paid more than they had to — is an ambiguous undertaking. A basic comparison of whether they paid anything above the minimum runs into a few questions. If someone rounds up a $3.99 item to $4, are they generous? What about if someone pays anything above $0 for a pure PWYW product? And since the buyer has to pay something to cover processing fees (which usually works out to around $0.40), how do you determine when they’re simply paying the barest minimum?

For the purposes of this study, including this graph and all others in which we explore the term, "generosity" refers to any payment of at least 2 cents/pence/etc. above the item price. This ideally controls against people who are just rounding up the penny (or whatever pennies might be in the seller's country), and signals some sort of generous intent. Additionally, we only examine items that have price floors, since instituting a threshold would be a doomed enterprise, given the impossibility of setting a single standard that would make sense across every currency.

The ratios here only apply to people who paid at least at the generosity threshold of >=2 cents/pence/etc. above the minimum. That means that, unlike the regular payment ratio in the first graph, the mean and median don't include sales for which the sales price and item price were the same. We use both metrics in other graphs and will indicate when each is being used.

In March 2020, the company launched the first Bandcamp Friday, an initiative to support artists by waiving the 15-percent cut it usually takes in sales. The event was so popular2 that the company has continued holding them on the first Friday of every month since.

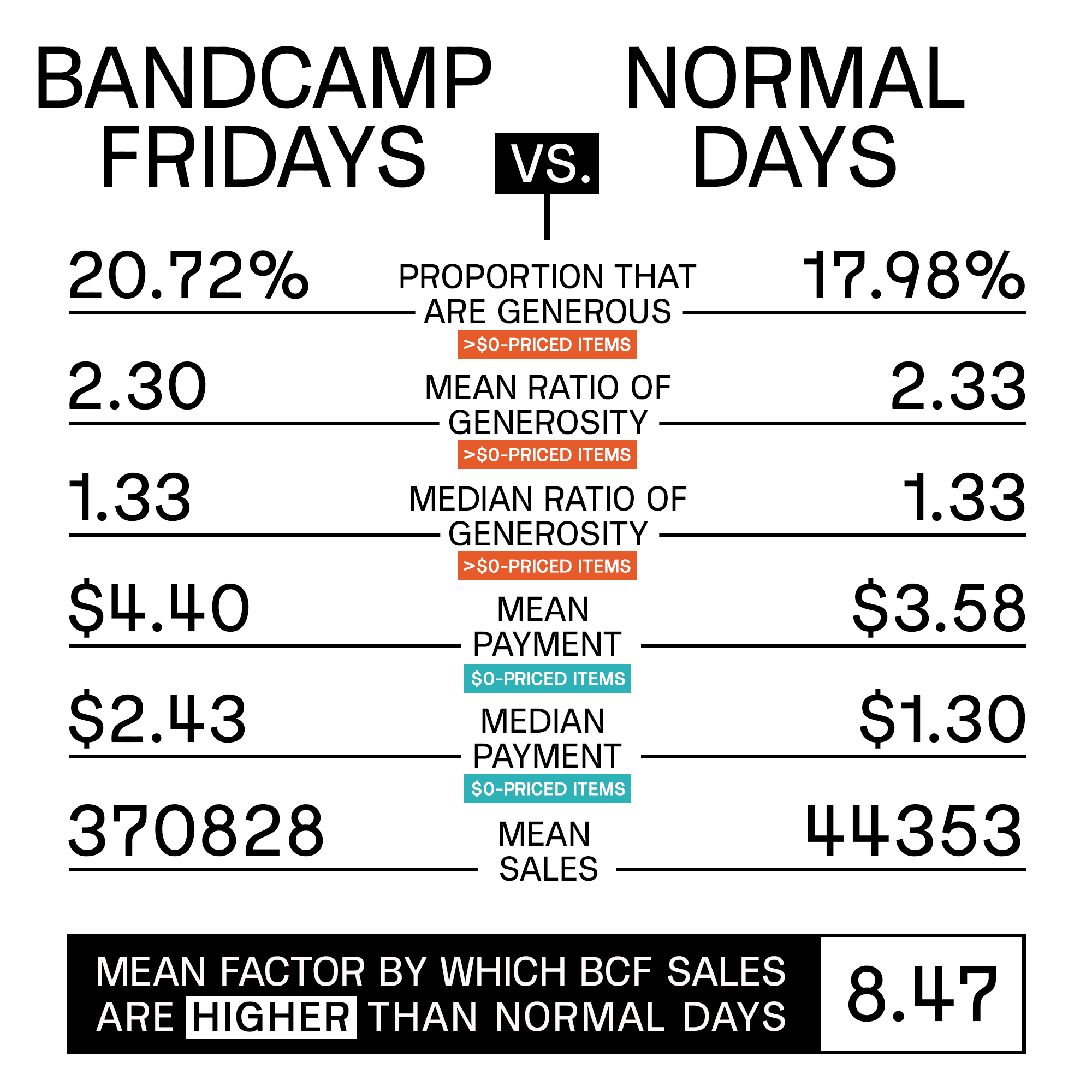

Something interesting shows up when you look at the buyer behavior on BCF and normal days side-by-side. A little under 3 percent more people pay at or above the generosity threshold on BCF than on normal days, which is maybe significant, but maybe not.3 But while the magnitude of that generosity is the same for items with price floors, people spend much more on $0-priced items on BCF than they do on all other days.

This might happen because of what behavioral economists have dubbed framing, in which buyers behave according to signals they're given. On BCF, the context of the purchase is a special day meant for supporting artists — a behavior typically thought of as altruistic. With $0-priced items, this signal might come through more clearly than with items that have prices, which act as their own competing signals.

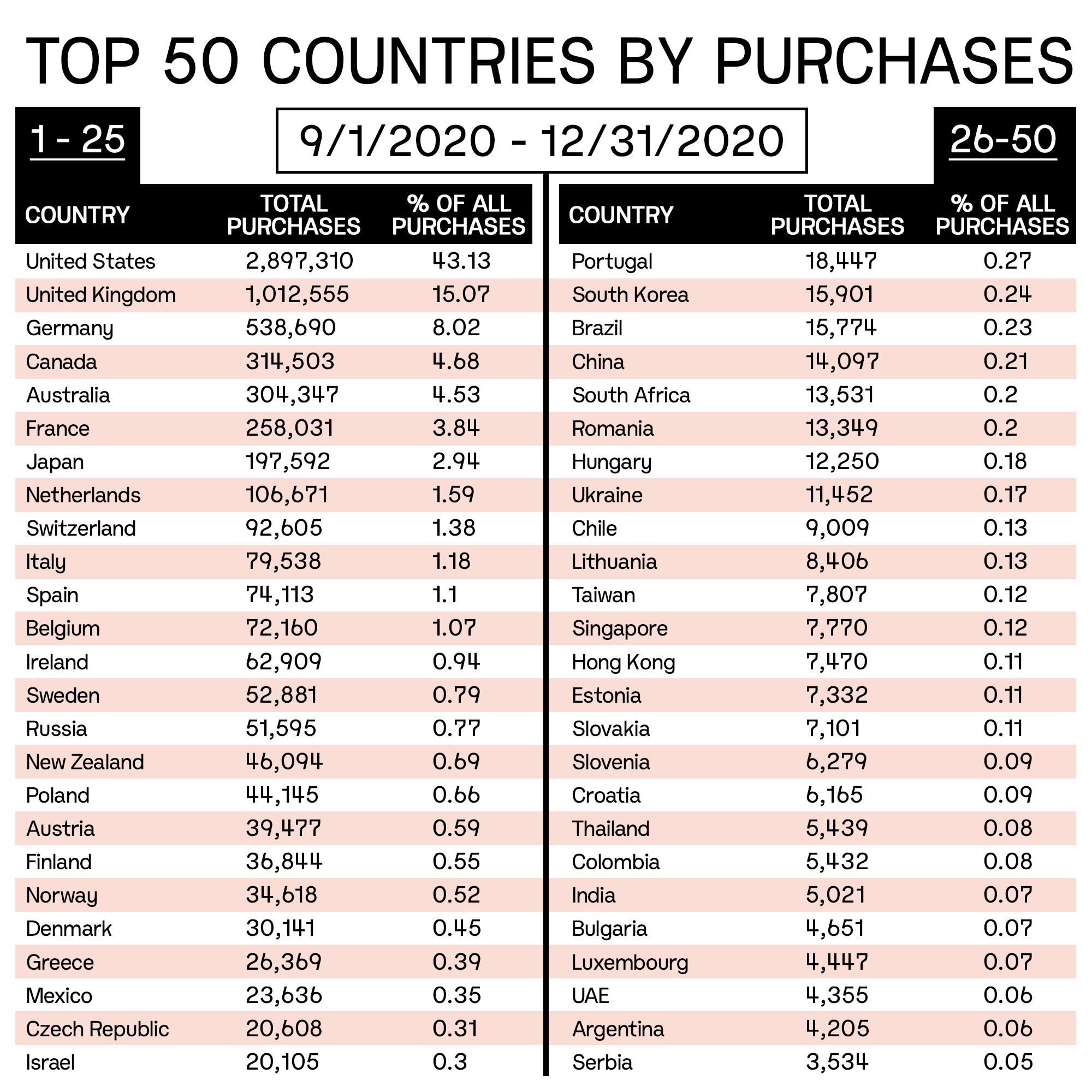

Geographically, Bandcamp is a largely American platform. A large plurality of its sales come from the United States, and a little more than 75 percent of all sales come from the top five countries, only one of which — Germany — is not predominantly English-speaking.

At the same time, Bandcamp’s architecture has proven flexible enough to give the platform staggering reach: users gravitate to the site from just about everywhere on earth, with representation across regions, languages, and global income brackets.

The precise extent to which activity on Bandcamp correlates with country population wasn't explored. At a glance, no obvious relationship between the two variables exists that would wholly explain the make-up of this list, which would imply the variance comes from elsewhere — per-capita income, the use of other means for listening and buying music, cultural predilections, and so on.

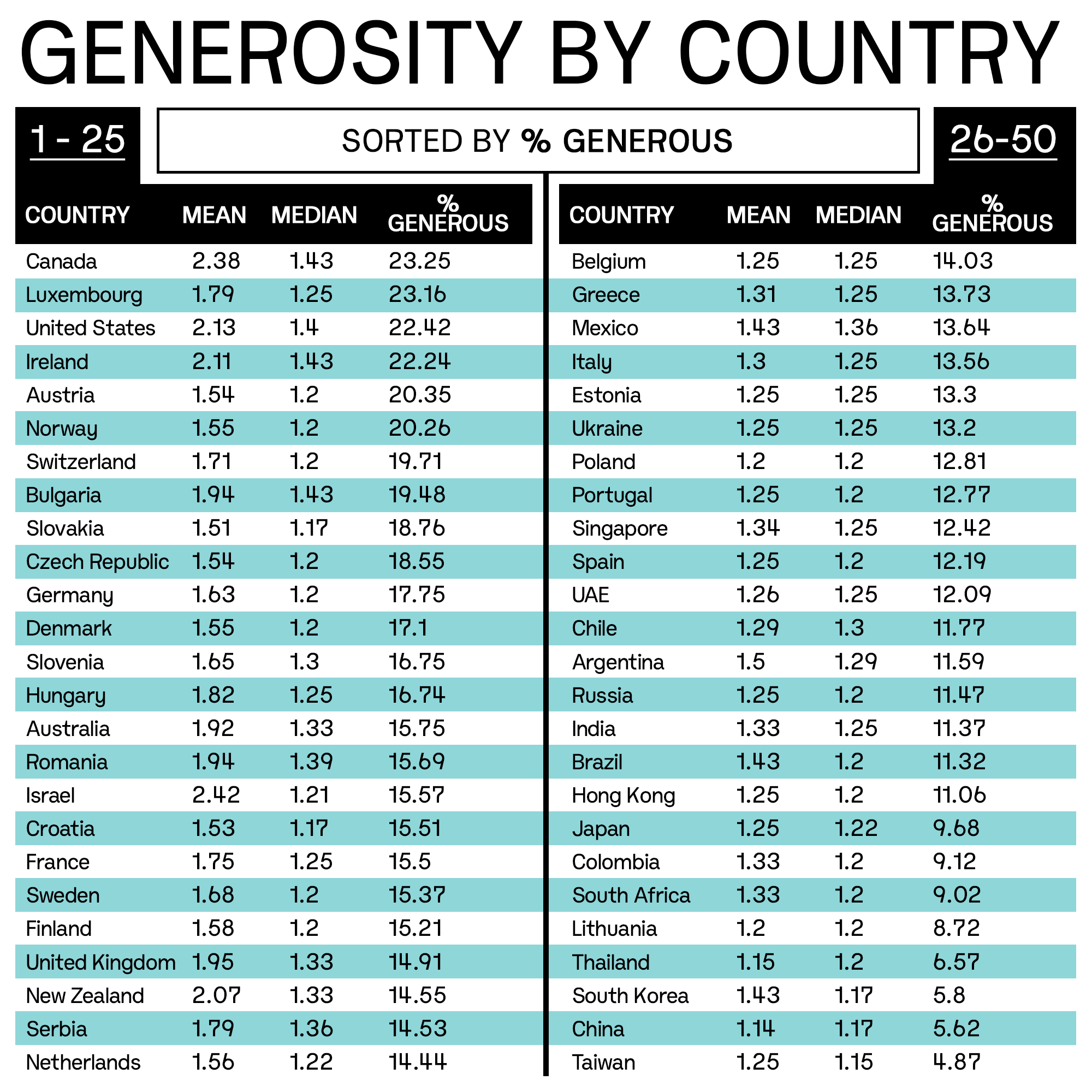

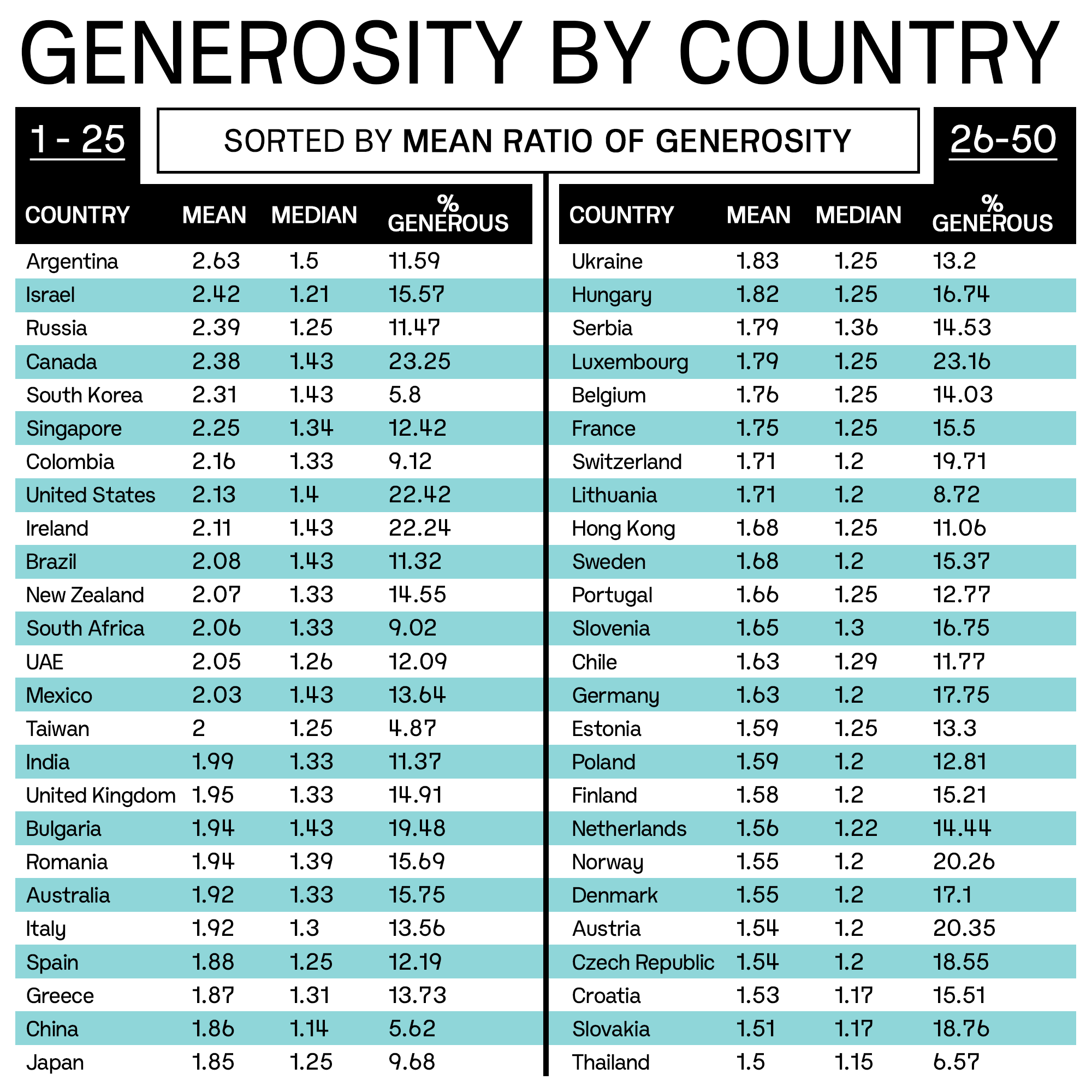

This is how the generosity calculations break down for each of the top 50 countries. The mean and median here are measures of the ratio of generosity — i.e., for the people who did spend >= 2 cents/pence/etc. above the item price, the magnitude by which they did so.4

Nothing was controlled for in determining the percentage of generous buyers, including currency, per-capita income, etc. Were such controls included, the countries might shift around, or they might not. What is extremely unlikely, though, is a complete flattening of the differences captured by this metric, and the results at least point to geography as a variable in determining why people pay what they do.

Sorting by a different column only confirms the difficulty in finding clear patterns. There is seemingly no correlation between the rate and magnitudes of generosity for each country,5 and even buyers in countries more likely to pay over the minimum don't necessarily pay more when they do pay over, and vice versa. Again, all that's concludable is geography's role as an additional complicating factor.

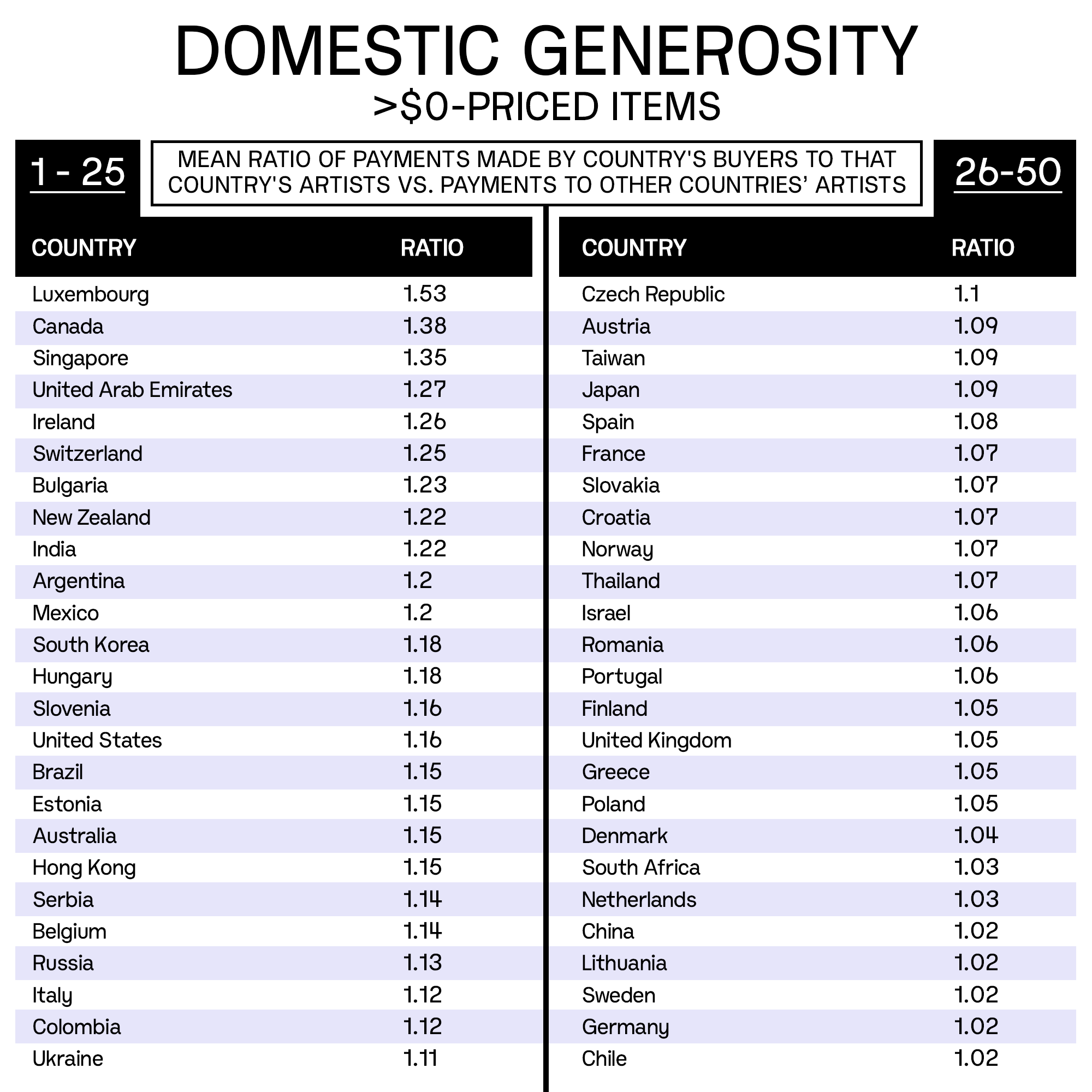

Below, next to each country is a measure of how much buyers in that country pay artists in their own countries compared to how much they pay artists from other countries. To illustrate this, let's say you have a Nigerian artist and a Nigerian buyer. The artist prices their item at ₦800, and the buyer pays ₦1600. The ratio is 2. Now let's say that same buyer purchases an album priced at €1 from an artist in France, and they pay €1,50. The ratio is 1.5. If that buyer were the only buyer in Nigeria, and these were the only purchases they made, then Nigeria's ratio in this chart would be 2 / 1.5 = 1.33. A ratio greater than 1 indicates that the country’s users are spending more on domestic purchases than they are on international ones, while a ratio lower than 1 would mean the opposite.

On average, buyers are more generous to artists in their own countries. This is not specific to certain countries or regions, and it appears to have nothing to do with relative currency strength. It is true for every single country in the top 50 countries studied, and it is probably true for those beyond the top 50 as well.

Fully elucidating the meaning of this graph requires volumes; in an earlier conception of this project, it was the report's main focus. But we're not even halfway done, so we're going to keep this part short: People are compelled to spend money on things with which they self-identify.6

The most reasonable interpretation of this graph is that it captures multiple moments of shared self-identification: people who know each other,7 people who feel affinity for a local geography, the shared culture more likely to emerge within a country, and even the likelihood that the experience of the artist results in music more likely to resonate with that of the listener.

What's important is that the many synapses of identity and a sense of being fire in different ways, and a shared nationality casts a net wide enough to capture many of them at the same time — all of this in spite of Bandcamp being a platform that otherwise facilitates the globalization of music.

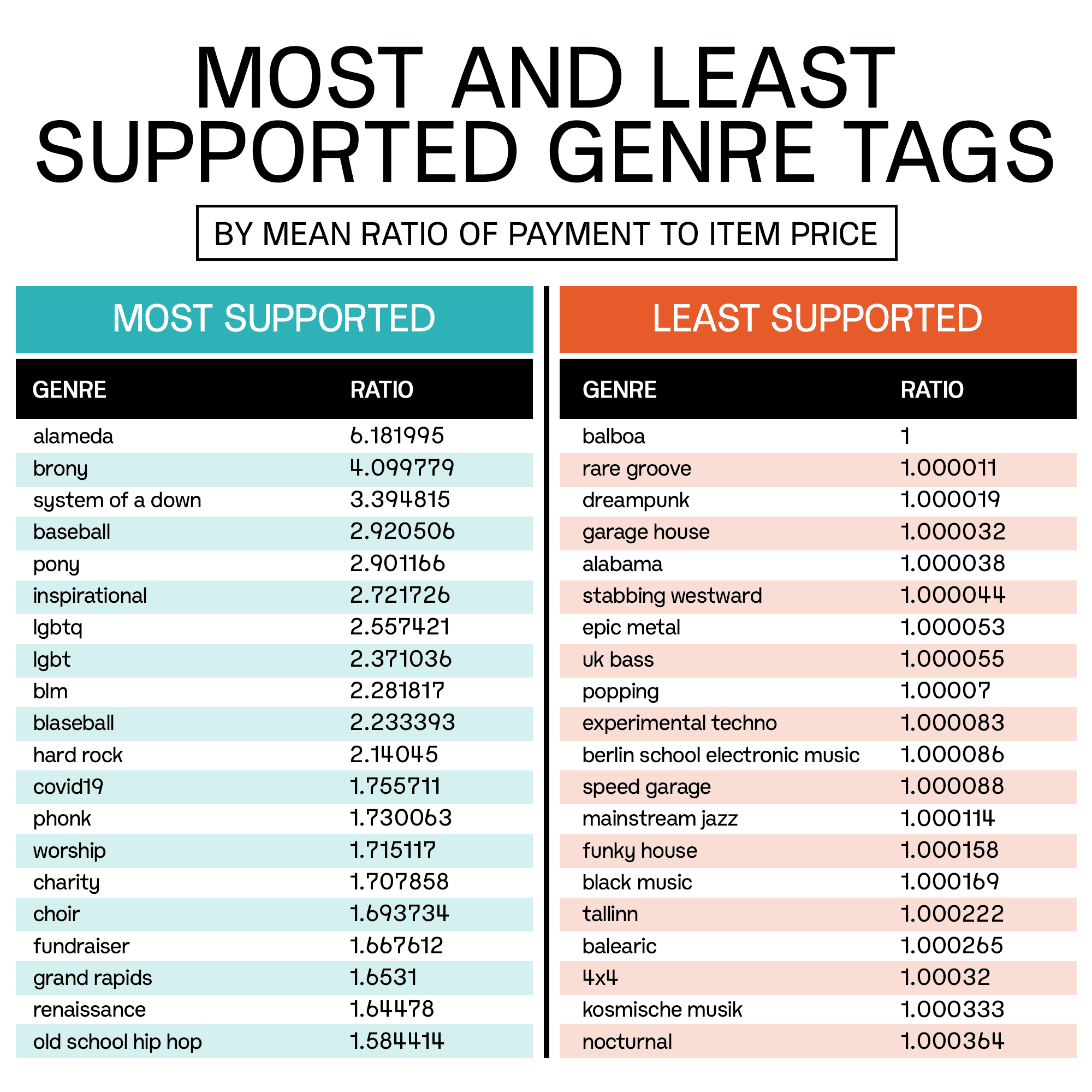

For this chart, we analyzed only albums (not tracks) priced between $1 and $10,8 and only genre tags that occurred in at least 500 sales. We explored the challenge of analyzing Bandcamp's genre tags previously, as artists are free to attach whatever tags they like. Digging more deeply into what each of these genres actually refers to both affirms and complicates the hypothesis of connection and identity that emerged in the previous graph.

For example, "Brony", "BLM", and "LGBT"/"LGBTQ" are relatively clear instances of identity-centered tags. "Charity" and "Fundraiser" by themselve are not. It turns out many of these tags are in fact reflecting both types of affiliation.

The genre tag "Alameda" is a reference to the city in the Bay Area. The only album in this dataset with the "Alameda" tag is Ska Against Racism, a compilation whose proceeds went to anti-racist organizations. Similarly, "System of a Down" refers to that band's release of a two-track EP to raise money for victims of the Armenia-Azerbaijan conflict.9 The "Hard Rock" tag is disproportionately associated with that same EP, a co-occurrence similar to that of "Brony" and "Pony". Even "LGBT"/"LGBTQ" is not strictly identitarian, as one of its highest-selling, highest-ratio albums was associated with a charitable cause.10 The high ratio of "Blaseball"/"Baseball," a pair of genres associated with the Seattle band The Garages, is primarily captured in an album whose proceeds went to a children's charity.

Where does this leave us? What matters and what doesn't?

The point is that it all matters. The item type matters and the locations of the parties on both sides of the transaction matter. The charitable nature of the sale matters, and the identity of the seller matters. It matters whether buyer and seller have met or whether they're strangers. Whether an item is priced at $0 or priced at $20, whether it's on a day when the artist is reaping the entire sale or just most of it — those matter too. Everything in the data matters, and most everything beyond the data also probably matters, from the way the item is described on its page to the number of tracks in an album to whether it's a limited edition to the album art.

And once you've found everything you can measure directly from Bandcamp's data, you'll have to account for all the things that you can't. Was the buyer in love or suffering a manic episode when they made the purchase? Did they grow up with lots of music around? Do they live in a metropolitan area of more than 1 million people? Are they chronic nicotine users?

We're halfway done with this report, and hopefully you read to the end. But if you don't, leave with this: Bandcamp has become an extremely rare type of company, a profitable startup, by doing nothing more than providing a threadbare platform for the chaotic variables of human experience to interact during economic transactions. This basic model is so effective that it works in spite of every other shortcoming the site suffers from.

That Bandcamp is in fact both profitable and a startup may come as a surprise to some. In 2010, Bandcamp received two Series A investments: one from the Menlo Park-based venture firm True Ventures, and one from the investor Brad Garlinghouse. True Ventures' successful exits include Peloton and Fitbit, which both went public, as well as Ring, which was acquired by Amazon. Garlinghouse has since 2017 been the CEO of Ripple, which as of the date of writing this is the seventh largest cryptocurrency by market cap, and in the 2017 boom saw its value surge by more than 3,600 percent.

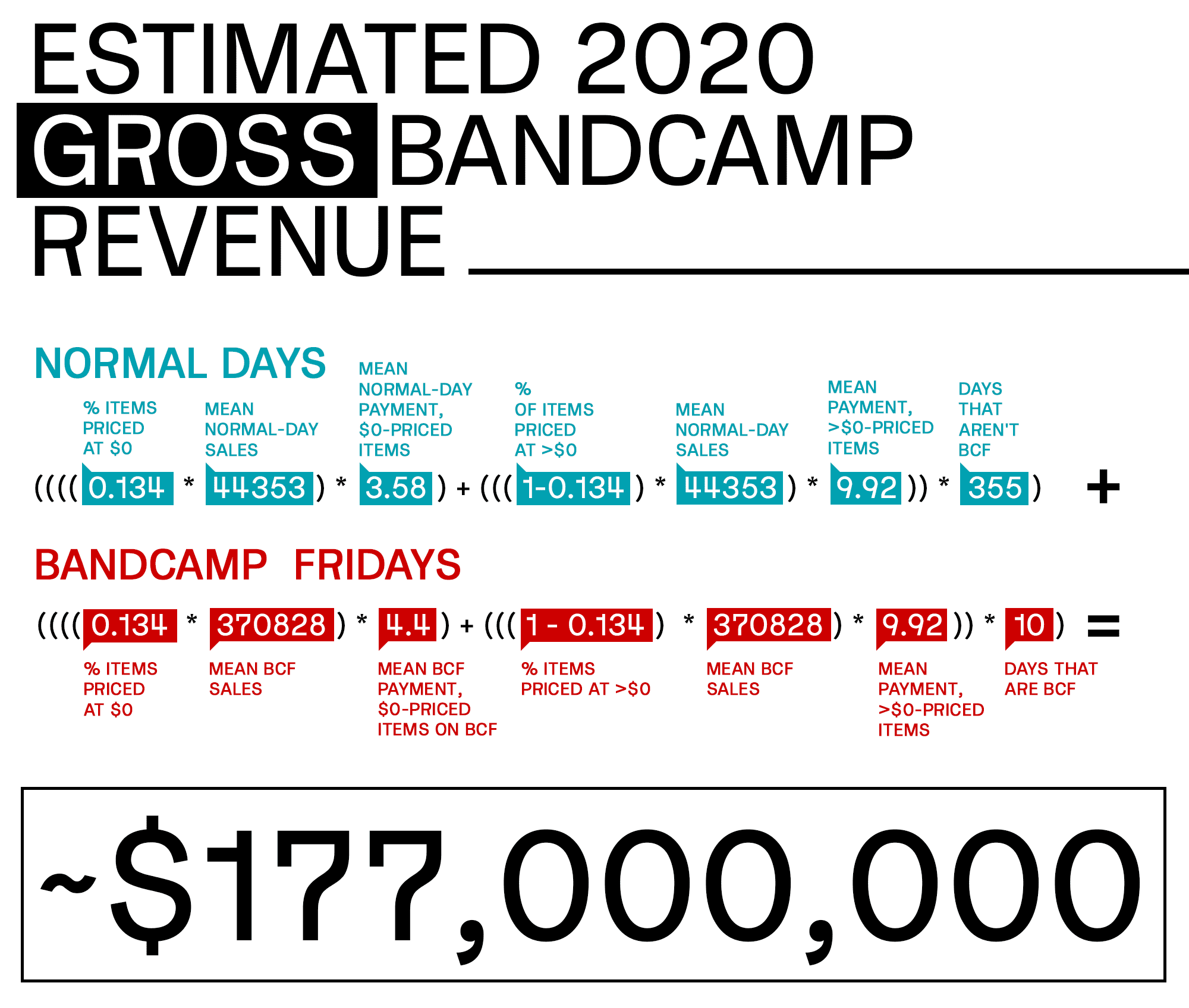

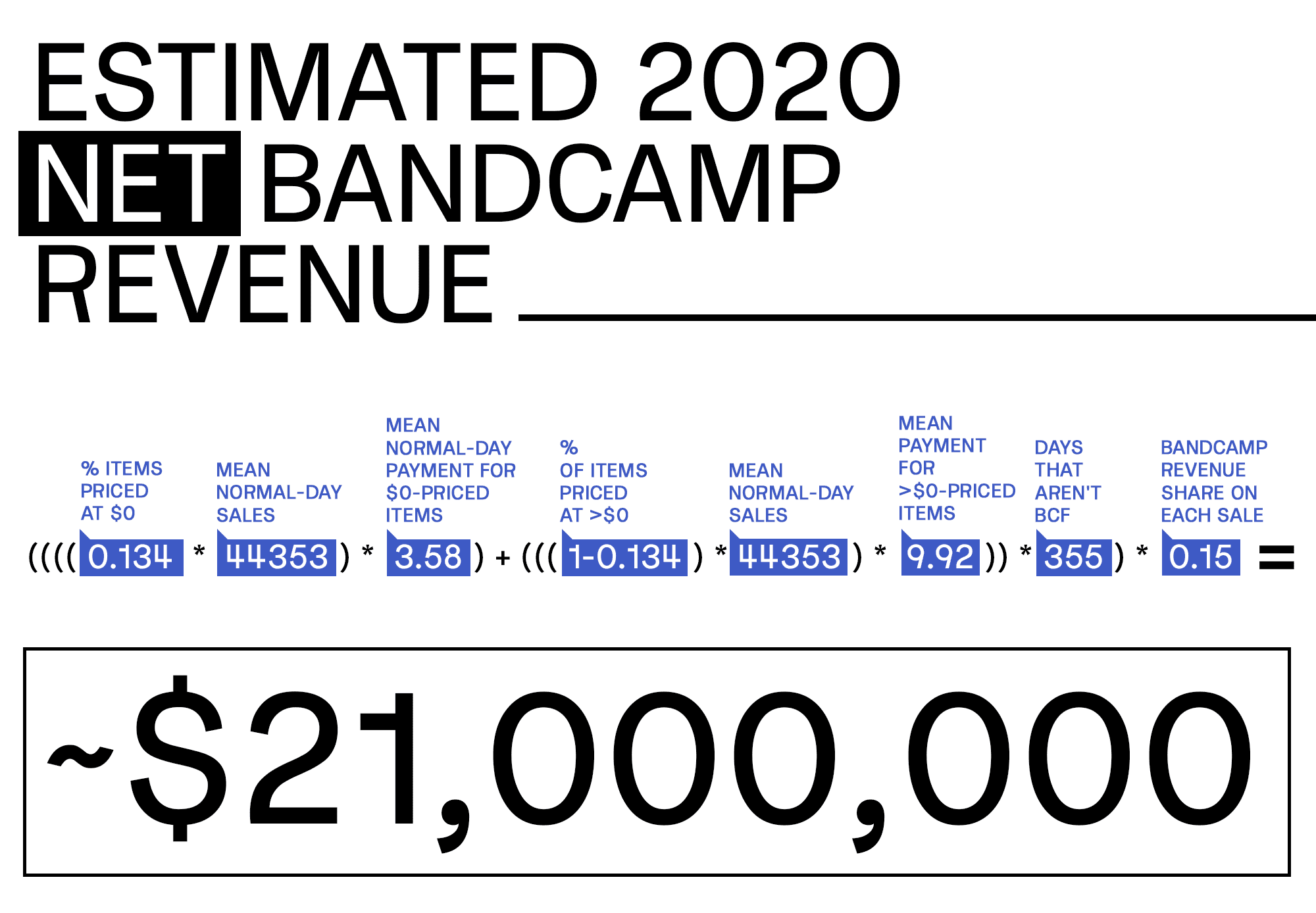

Doing a bit of napkin math, this is what we estimate the company's total revenue to have been last year, including BCF sales, and accounting for a few of the higher-level distinctions in payments based on item prices and so on. We did not take into account differences in item types beyond albums vs. tracks.

And this is what we estimate the company made last year from its 15-percent fee. This number does not include BCF sales and similarly accounts for the differences in prices based on normal days vs. BCF, as well as item prices.

Diamond, the Bandcamp CEO, has said his company has been profitable since 2012. If we had no other information than this estimate alone, we'd believe him. $21 million is more than enough to cover the company's operating costs, including the salaries of its employees, the costs of its servers, and its rent on both its office and its physical record store in Oakland.

But we have more than just this estimate. We know the company hasn't taken another investment since its 2010 Series A and the lights are still on. We know it hasn't been cannibalized by a private equity company who saw opportunity in a distressed asset. There's no reason to doubt Diamond's claim.

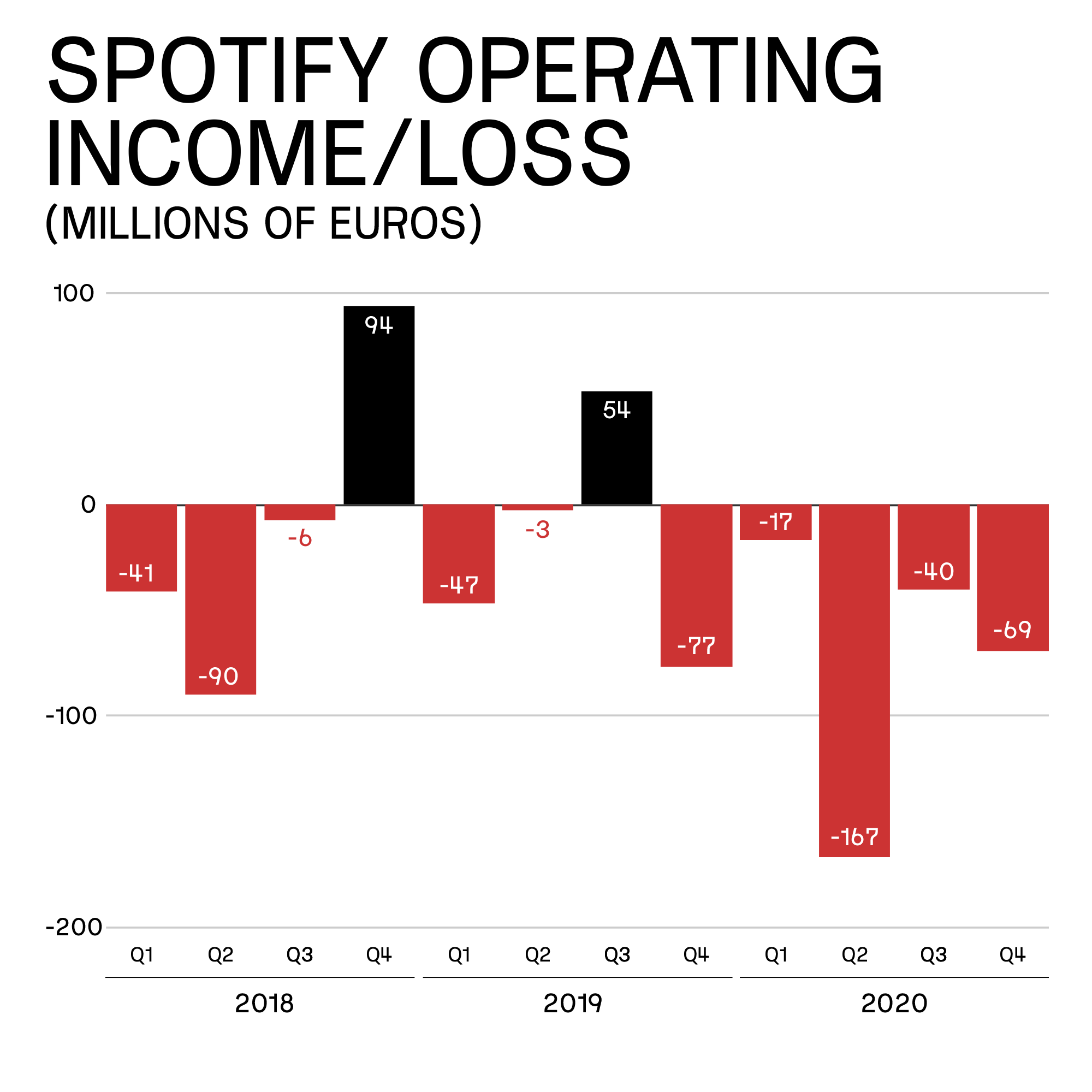

With that in mind, let's look at one last graph.

As unaware as people might be that Bandcamp is both profitable and a startup, they're also often unaware that Spotify is deeply unprofitable. For the most part, Spotify does nothing but lose money. Buying exclusive rights to podcasts and paying large record labels licensing fees while charging users no more than $9.99 (a monthly subscription fee the company may raise), most of whom choose not to pay, is expensive.

This is because Spotify's understanding of humans as economic actors is almost maximally reductive, antiquated, and fundamentally flawed.

Its misconception begins with a straightforward musical misconception: given a listener's mood, Spotify should provide them with music to match that mood. This has been the explicit mission statement of CEO Daniel Ek from the beginning, and it was the idea behind its "music for every mood" advertising campaign, which it ran until last year. If someone is going for a walk in the park in autumn, they should be provided with Autumn Walk music. If they've broken up with someone, they should be provided with Break Up music. If you've ever encountered a ridiculously named Spotify-curated playlist like DayDreamer, Piano in the Background, or Cinematic Chillout, you've glimpsed this ambition.

The end game here isn't hard to fathom: If autumn walks and day dreaming are best accompanied by certain music, and we can figure out what those sounds are, why have artists make them at all? The company has intimated at this future so hard as to almost issue a press release. Meanwhile, the company has pursued dominance through exclusive deals with star podcasters like Joe Rogan and the acquisition of companies like Gimlet Media, effectively buying up podcast market share in an attempt to monopolize the market and control the equivalent of the Google Ads of audio advertising.

In both regards, Spotify is pursuing the twin prongs of a standard Silicon Valley business model, in which a company burns investor cash until humans have been removed entirely (a la Uber with self-driving cars) and/or until there's almost nowhere else left for consumers to go to get what they previously purchased from a variety of sources (a la Amazon). Doing the first thing doesn't always pan out, as ridesharing companies have discovered. And doing the second both takes a long time and is only possible because of a weak antitrust apparatus in the US that has for decades allowed predatory pricing (i.e., pricing below cost to push out competitors) and no-questions-asked mergers and acquisitions — and that apparatus is rapidly course correcting.

But Spotify's business is built on more than delusion and illegality — it's also a patently stupid model that disregards the past few decades of behavioral economics research and insists on seeing users as rational actors who simply seek the most goods for the lowest price.

As Chris Golinski, whose PhD dissertation at UC-San Diego examined Bandcamp users, pointed out to us, Spotify's model ignores even the basic principle that 20 percent of buyers usually account for 80 percent of purchases. Instead, the value of each Spotify user is capped at a monthly subscription price.11 By denying buyers the possibility of direct economic relationships with sellers, Spotify has no choice but to continue to pursue its delusional, illegal, stupid business model, which is less interested in finding ways for people to pay for music than in popularizing a mode of listening that people only begrudgingly pay for.

So Bandcamp is profitable and Spotify is not. One is built on the creation of value, the other on speculative fervor. Bandcamp built a modern business model on what often feels like outmoded tech, while Spotify built an outmoded business model on modern tech.

Why do investors pour money into one and not the other? Why are True Ventures and Garlinghouse, who, as the company's only listed investors, most likely sit on Bandcamp's board, not pushing for the company to modernize its architecture, aggressively market itself, and demand all manner of things venture investors do to effectively put a gun to CEOs' heads and tell them to grow or die?

Here's a total conjecture that could be completely wrong, but is one possibility nonetheless:

Ironically, it could be because of the company's very profitability. The idea of venture investment is that in a portfolio of ten companies, nine of them fail and one of them 100x's. Bandcamp has neither failed nor grown stratospherically. Instead, it has become a moderately profitable company without any expressed intent to take over the world. In doing so, it has become less like the hyper-growth stock Valley investors chase and more like a corporate bond or IBM stock in the 90's that reliably pays out dividends but won't make anyone as rich as Peloton or Ripple did. Further investment becomes a needless risk that jeopardizes a safe source of income.

If this is true, there are two developments that could unmoor this complacency.

First, the bets investors make that a start-up might eventually 100x have at least in part depended on illegal activity in the markets that go unchallenged by regulators. Companies like Facebook, Amazon and Google grew to their current sizes by pursuing strategies that even politically moderate policy makers now recognize as criminal. As they assumed their sizes, they also bought up portfolio companies from venture firms, allowing investors to exit. Both of these exit paths — becoming a monopoly or being acquired by one — could shrink as regulators examine the possibility of breaking up tech giants, and as they more closely scrutinize acquisitions.

Second, more than a decade after Bandcamp's 2008 founding, other investors, founders, and sellers have discovered that businesses that do facilitate economic relationships between sellers and customers — that let the countless variables interact as they will — are in fact cheaper to start and invest in and can become successful much more quickly. About 70 percent of Spotify's costs go to licensing fees with record companies. Patreon, OnlyFans, and Substack are stuck with no such costs, while also leveraging the varieties of economic experience, allowing people to fulfill the multitude of impulses they have to pay for things.

Just as we were wrapping up this report, Twitter and Square CEO Jack Dorsey announced that Square would acquire Tidal, the long beleaguered Norweigian music streaming service — an announcement that was preceded by Twitter's bid to acquire newsletter platform Revue. "Square created ecosystems of tools for sellers & individuals, and we’ll do the same for artists," Dorsey said in his tweet thread on the Tidal acquisition. "We’ll work on entirely new listening experiences to bring fans closer together, simple integrations for merch sales, modern collaboration tools, and new complementary revenue streams."

It's unclear precisely what Jack's enthusiasm for Tidal and Revue are. A worst case scenario probably involves NFTs. A less complicated and perhaps more likely scenario is that this is simply the new convention for creative platforms. Buyers want to directly pay creators for stuff, creators want to get paid. Barring world domination, it's more profitable to be a platform that allows that elemental transaction to happen than it is to refuse it.

If these are the signals the market is in fact sending, it could mean that Bandcamp is no longer the corporate bond or the blue chip stock, but closer to the growth company True Ventures and Garlinghouse hoped it might be when they first invested a decade ago.

With that in mind, here is a very incomplete list of things Bandcamp should do.

First, the company should extricate itself from a state of technological and branding inertia. Bandcamp, as much as it has endeared itself to artists and listeners (and, it should go without saying at this point, to us), the platform has felt like it calcified right after it was created. The site is slow. Elements of its layout are weirdly counterintuitive. You can't download music in the app, and the app allows only low-quality streaming.12 The API offers no meaningful ways to integrate the platform with outside services.

At the same time, beyond Bandcamp Daily — the site's in-house music publication — and a physical record store in downtown Oakland that most people will never encounter, the company seems to have no marketing, mostly resorting to artists themselves to market the platform for their own work. If we described the extent to which our research led us to people who have not even heard of Bandcamp (and somewhat harrowingly, this group includes decision makers at nontrivial record labels), the company's officers would feel rightfully perturbed.

The company should also step into a more experimental mode of operation that a totally behaviorally oriented business model demands to fully work. If people spend more on artists with whom they share a city, see if directly promoting work in their cities induces more spending. If something pops up like Buy Music Club, a site that is an independently created way of sharing Bandcamp playlists and recommendations, acquire the site and integrate it into the app.13 Build out the API so that, for example, NTS Radio DJs can easily integrate the album/track pages into track lists.14 And so on.

Second, the company should actively entice more large artists to release music on the platform to not only bring in more revenue, but also to normalize the platform beyond its niche position. Convince a few larger artists to release an EP not available on streaming platforms15 and see what happens. Phoebe Bridgers, an artist who according to Spotify popularity scores is exactly on par with Charli XCX, brought in more than $178,000 from a single limited edition track released exclusively on Bandcamp that raised money for charity. What would happen if none of it went to charity?16 10 percent of it? What if it were a full album instead of a track?

Again, we don't know, but the sale of the track does begin to give lie to the claim that the fans of larger artists are passively absorbant of whatever sound the artist emits — that there is in fact a relationship there, and as such, there is an economics. And while the data on how popularity modulates willingness to pay is unclear, Golinski's research concluded that, at the very least, people who like more popular artists are not therefore less likely to use Bandcamp itself. However, it's worth recounting that the willingness of Radiohead fans to voluntarily pay the band was the company's foundational observation.

Third, since all our fates are intertwined and things in the universe are connected and so on, Bandcamp should recognize that it can grow the most under certain market conditions that favor it. The conditions most beneficial to Bandcamp are those that favor value creation and that disfavor empty speculation and criminality. To that end, the company should consider meeting with other companies that stand to benefit from rigorous antitrust enforcement, like DuckDuckGo, Affinity, and a whole host of others, form a trade group, and hire some lobbyists.

Right now, the only related group that exists is the Coalition for App Fairness, a trade group formed by Basecamp and Epic Games primarily interested in reducing Apple's 30-percent app store fees. Reducing these fees is, in the long run, probably important for Bandcamp to reach a certain level of growth: The entire reason that Bandcamp does not allow in-app purchases is so that it can preserve its revenue split with artists without having to also cut in a trillion-dollar company. As of this writing, the Coalition has already successfully gotten the Arizona House of Representatives to pass a bill that would force Apple and Google to allow alternative payment methods to circumvent their gatekeeping.

Bandcamp should probably join, but it should go beyond this. One of the Coalition's members is Spotify, which has for years ironically accused Apple and Google of monopolistic behavior. This is the perhaps the only antitrust issue Spotify stands to gain from fixing. In this case, Spotify's and Bandcamp's interests are unusually aligned. But the types of market conditions that would benefit Bandcamp, DuckDuckGo, Affinity, and the others extend far beyond the confines of the app store and into the very bones of our economy. So far as we know, there is currently no trade group advocating in this area. Bandcamp should help start it. If it turns out one exists, it should join.

But despite recent anti-monopoly efforts by US legislators — many of which will directly affect today’s music industry — Bandcamp’s best moves may be beyond North America. A recent report tabled by UCL London describes the broader crises within creative industries within the United Kingdom, describing a significant loss of agency and income for all emergent and established creative sectors. Alongside local economic policy, the report identifies monopolized tech platforms as a primary driver of this crisis. Bandcamp stands uniquely positioned against this form of antitrust, and its expertise could inform intellectual property reform, digital distribution legislation, pricing thresholds, ownership, and more as part of a larger strategic position.

Finally, if any of these suggestions are too much for the company's past investors to swallow (conjecturally/hypothetically/etc.), the founders and/or employees should see if there's a way to buy them out. Hopefully the opposite is true, and the investors actually understand that starting a new Spotify is not smart, that the political tides have changed, and that the odds of Bandcamp becoming the portfolio whale they hoped for in the beginning, by creating value instead of violating antitrust regulations, is greater now than it was ten years ago.

We'll end on this note:

We think there is enough information in this report for different readers to take away whatever they find valuable and ignore or dismiss what they don't, so long as they keep in mind the overarching points: That Bandcamp's model is antifragile and Spotify's is not, which is why Bandcamp is profitable and Spotify is not. We'll add one more non-negotiable takeaway, which is that Bandcamp is a company founded by people who respect music and Spotify is not. This is the ur-distinction between the two from which all others originate.

Spotify will never deliver what its artists endlessly appeal for: Fair remuneration and good-faith avenues for artist development that don't involve payola or the equivalent of musical SEO. It will not do this because the existence of music beyond basic hormonal modulation does not interest it, and therefore, the existence of musicians does not interest it. The precise extent to which the same can be said of Apple Music (the second-largest streaming platform) or Amazon Music (the third) is debatable, but in most regards, they've made no marked gestures in the opposite direction.

Perhaps all of this is overstating the existence of competition between the two ecosystems; in many ways, they can be seen as complementary, as streaming provides an avenue for music discovery and Bandcamp an avenue for economic relationships — Diamond once compared Spotify to the radio, a place to find new artists. Except that while Bandcamp may see streaming platforms as a complement, Amazon, Apple, and Spotify, which have spent the past decade devouring entire markets, rarely see themselves as complements to anything.

In the course of this research, one of us suggested to someone at a record label that publishes its artists' music exclusively on streaming platforms that they should throw a few tracks on Bandcamp and see what happens. The person said they'd bring it up to others in the company "as an idea for any artists who want to pursue...the 'underground' look."

Every recommendation made here is a facet of a single exhortation: that Bandcamp do everything it can so that no one sends an email like this ever again.

Acknowledgements

Special thanks to Cade Diehm (New Design Congress), Chris Golinski (HP), Ayelet Gneezy (UC-San Diego, Rady School of Management), Minah Jung (NYU, Stern School of Business), and Matt Stoller (American Economic Liberties Project) for their conversations and feedback throughout this project.

If you liked this report, you can sign up for our newsletter here.

If you didn't and would like to lodge a complaint, contact mail@components.one.